India’s mergers and acquisitions (M&A) exercise witnessed a blended efficiency within the first half of 2024, with deal worth rising barely however the variety of offers declining considerably in comparison with the identical interval final yr. This development is mirrored within the funding banking sector, the place general charges dropped regardless of a surge in fairness capital market (ECM) underwriting charges.

M&A Exercise: Worth Up, Quantity Down

Whereas the full deal worth for introduced M&A offers involving India reached $37.3 billion within the first half of 2024, a 4.4% enhance year-on-year, the variety of offers dropped by 18.4%. This decline was significantly pronounced within the mid-market phase (offers valued as much as $500 million), which noticed a 19% lower in deal depend, representing the slowest exercise because the first half of 2021.

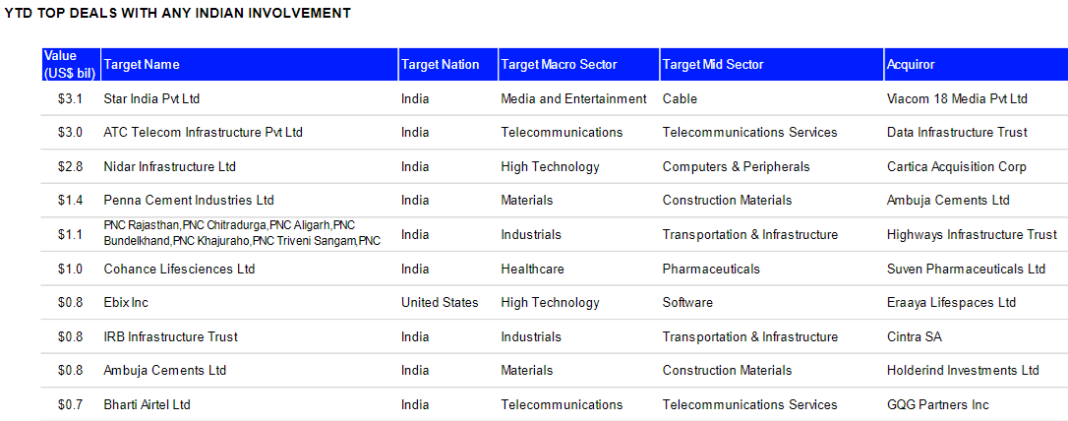

Nevertheless, there have been shiny spots. The primary half of 2024 noticed at the very least six offers exceeding US$1 billion, together with the high-profile US$3.1 billion merger between Walt Disney and Reliance Industries’ media belongings and the US$3.0 billion merger between Information Infrastructure Belief and ATC India.

Breaking Down the Offers:

- Home M&A: US$17.2 billion (down 8.8% year-on-year) – This means a slight lower in consolidation throughout the Indian market.

- Inbound M&A: US$17.2 billion (up 32.4% year-on-year) – This important rise exhibits elevated overseas investor curiosity in Indian corporations. The USA was probably the most energetic acquirer on this class.

- Outbound M&A: US$2.7 billion (down 29.0% year-on-year) – This sharp decline suggests Indian corporations are taking a extra cautious method to abroad acquisitions.

Indian-involvement offers focusing on Expertise, Media & Leisure, and Telecommunications (TMT) sector reached $14 billion, greater than double the deal worth introduced throughout the identical interval final yr. This development displays India’s sturdy financial fundamentals, authorities initiatives selling digitalization, and the attractiveness of the Indian marketplace for tech-related companies.

Extra From This Part

Media and Expertise Dominate: The highest two offers contain corporations within the Media and Leisure (Star India) and Telecommunications (ATC Telecom Infrastructure) sectors

Mixture of Home and Worldwide Offers: The desk contains each home offers (Indian corporations buying different Indian corporations) and inbound offers (overseas corporations buying Indian corporations). This displays the rising participation of overseas buyers within the Indian market.

Fairness Capital Markets Growth

India’s fairness capital markets carried out exceptionally properly through the first half of 2024. Fairness fundraising reached document ranges, with corporations elevating $29.5 billion in proceeds, greater than double the quantity raised in the identical interval final yr. This growth was pushed by a major enhance in follow-on choices (FPOs) and block trades. FPO proceeds grew by 156% year-on-year, whereas block trades raised US$16.4 billion, a 117% enhance. IPO exercise additionally noticed constructive development, with Indian corporations elevating US$4.4 billion, up 98% from the primary half of 2023.

Funding Banking Charges: A Combined Bag

Whereas the general funding banking charge pool in India declined by 11% in comparison with the primary half of 2023, ECM underwriting charges surged by 127%, reaching the very best first-half complete since 2007. This rise displays the exercise within the fairness capital markets. Nevertheless, charges from different segments, similar to Debt Capital Markets (DCM), syndicated lending, and M&A advisory, skilled important declines. Here is a breakdown of the funding banking charge panorama:

- Complete Charges: US$530.4 million (down 11% year-on-year)

- ECM Underwriting Charges: US$243.8 million (up 127% year-on-year)

- DCM Underwriting Charges: US$114.9 million (down 22% year-on-year)

- Syndicated Lending Charges: US$80.8 million (down 51% year-on-year)

- M&A Advisory Charges: US$90.8 million (down 47% year-on-year)

- Kotak Mahindra Financial institution emerged as the highest participant in funding banking charges, with a complete of US$40.6 million, capturing a 7.6% share of the Indian market.

“Majority of the deal making exercise involving India focused the Excessive Expertise sector which totaled US$5.8 billion, a 13.2% enhance in worth from the comparative interval final yr and accounted for 15.6% market share. Industrials totaled US$5.0 billion, down 26.1% from the primary half of 2023, capturing 13.6% market share. Financials rounded out the highest three sectors with 11.9% market share. Telecommunications and Media & Leisure with 11.4% and 10.8% market share, respectively, noticed important triple-digit share development from a yr in the past,” stated Elaine Tan, Senior Supervisor at LSEG Offers Intelligence.

Personal equity-backed M&A in India amounted to US$5.7 billion, down 33.7% from a yr in the past, and the bottom first half complete since 2020.

First Revealed: Jul 10 2024 | 1:31 PM IST

Adblock take a look at (Why?)